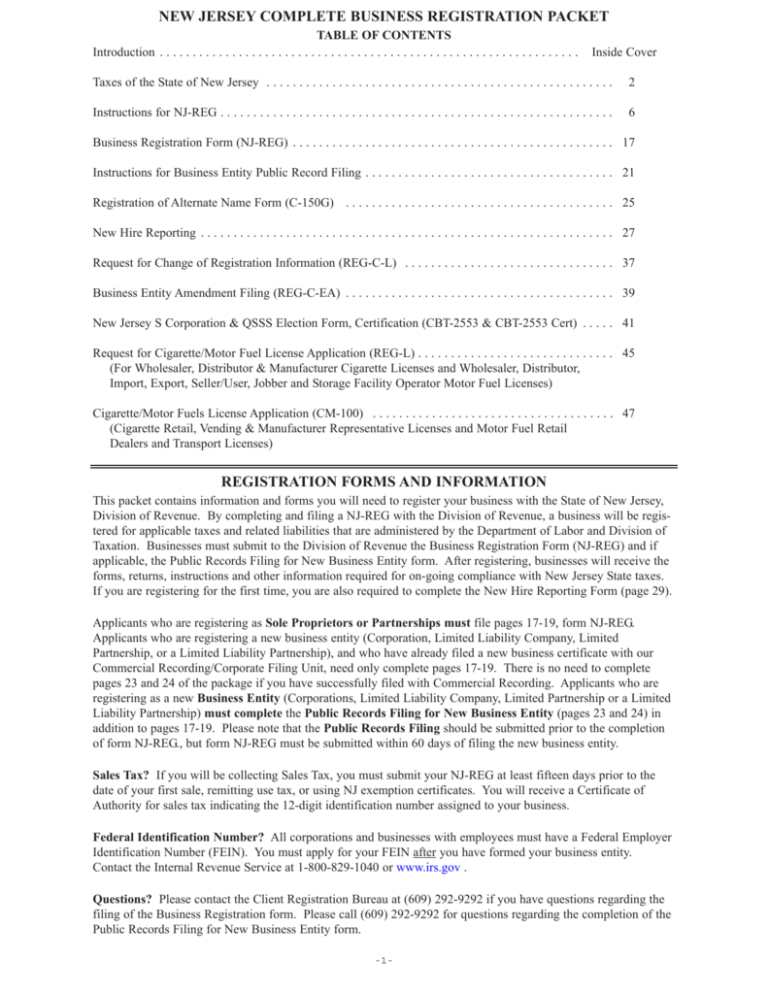

nj bait tax instructions

So I looked it up and it seems that New Jersey has a new way to tax Pass Through Entities with a Business Alternatives Income Tax Makes me glad I live in a state where I can pump my own gas. You did maintain a permanent home outside of New Jersey.

2022 Pass-Through Business Alternative Income Tax Statement of Estimated Tax Instructions Keywords.

. Nj Bait Tax Instructions. Its estimated to save New Jersey business owners 200 to 400 million annually. A New Jersey S Corporation is not included as a member of a.

The 2021 PTE-200-T Extension of Time to File grants a six-month extension to September 15 2022. On or before the original due date of the return March 15 for calendar year filers. How NJ CBT-100S filers ie S corporations can calculate their distributive proceeds using Form NJ-NR-A Business Allocation Schedule.

NJ Division of Taxation. Taxpayers who earn income from pass-through businesses and pay. If you are a nonresident and your income for the entire year was more than the filing threshold amount for your filing status you must file a new jersey nonresident tax return.

On january 13 2019 the new jersey governor signed s. Any resident or part-year resident can use it. MarriedCU couple filing joint return Head of household Qualifying window ersurviving CU partner.

Estates and Trusts Understanding Income Tax GIT-12 January 2022 Estates Other Than of a Deceased Individual For New Jersey tax purposes the term estate refers only to the estate of a deceased person. COVID-19 is still active. Pass-Through Business Alternative Income Tax Act.

This is an entity-level tax to work around the 10000 cap on State and Local tax as a part of individuals itemized deductions. An Important Discussion About the NJ BAIT. If filing for a fiscal year or a short tax year enter at the top of the PTE-100 the month day and year the tax year began and the month day and year it ended.

Nj bait tax instructions. 2021 PTE-200-T Instructions Author. Instructions for Pass-Through Business Alternative Income Tax Application for Extension to File Form PTE-100.

On January 13 2020 New Jersey Governor Phil Murphy signed the NJ SB3246 Pass-Through Business Alternative Income Tax Act into law. PL2019 c320 enacted the Pass-Through Business Alternative Income Tax Act effective for tax years beginning on or after January 1 2020. New Jersey Tax Nexus.

Pass-Through Business Alternative Income Tax Act. Along with payment must be filed online at njgovtaxation until 1159 pm. Im sure the OP knows more about it than I do and I dont use.

How to apply the BAIT non-payment safe harbor to a PTEs first-year BAIT election. The tax rates or circumstances of each owner is not considered. Application for extension of time to file nj gross income tax return.

The New Jersey Division of Taxation has provided answers to several recent questions about the New Jersey Business Alternative Income Tax BAIT. General Instructions for New Jersey S Corporation Business Tax Return and Related Forms - 2 - 187-116a1 through a7 must file the New Jersey Corporation. Call NJPIES Call Center.

A six-month extension of time to file your PTE-100 may be granted if at least 80 of the total tax reported on your PTE-100 when filed is paid by the original d. New Jersey Online Filing Use the free enhanced and upgraded New Jersey Online Filing Service to file your 2021 NJ-1040 return. You are a nonresident for tax purposes if.

Assume a PTE filed its 2021 BAIT return on March 1 2022. Stay up to date on vaccine information. Fishing a crowded pier in the Atlantic City NJ area.

ALTERNATIVE TO CAST NET FOR CATCHING LIVE BAIT. Et al as may be applicable to the collection administration and enforcement of the New Jersey gross income tax provided in the New Jersey Gross Income Tax Act NJS54A1-1 et seq and the New Jersey State Uniform Tax Procedure Law NJS5448-1 et seq except as otherwise provided by subsection b. PTE-150 instructionsPTE 150 instructionsPTE150 instructionspte-150 instructionspte 150 instructions.

You did not maintain a permanent home in New Jersey. Fishing and Cast Netting Mullet LBI NJ 916-2515. That BAIT Tax sure sounded like a can of worms.

Nonresident Withholding The new 2022 BAIT does not require a partnership or LLC taxed as a partnership to withhold New Jersey gross income tax. NJ Division of Taxation - Partnerships. To access the NJ Pass-Through Business Alternative Income Tax PTE filing and payment service click here or copy and paste the below address into your web browser.

In November 2020 the Internal Revenue Service agreed with the States PTE. MarriedCU partner filing separate return. For New Jersey purposes income and losses of a pass-through entity are passed through to its.

Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns. The new jersey business alternative income tax also referred to as bait or nj bait helps business owners mitigate the negative impact of the federal state and local tax salt. Its simple and easy to follow the instructions complete your NJ tax return and file it online.

Form CBT-100U Combined Corporation Business Tax Return. Instructions for Completing the. New Jersey Pass-Through Business Alternative Income Tax PTE Election.

December Edition Answer. The NJ DOT has announced that it will issue updated guidance ie form instructions and FAQs including. Rounding Off to Whole Dollars Money items can be shown in whole dollars eliminate.

Until 2022 there is a middle bracket of 912 for income between 1M and 5M. Returns due between March 15 2022 and June 15 2022 are due by June 15 2022This includes the 2021 PTE Election 2021 PTE-100 Tax Returns 2021 PTE-200-T 2021 Revocation forms and 2022 Estimated Payments. Contains the New Jersey election information and filing instructions.

Nj Pte 100 Instructions Nj Pte 100 Instructions nj bait instructions. Entities that do not have access to the internet can call the Divisions Customer Service Center at 609 292-6400. The tax year for New Jersey purposes must be the same as the tax year for federal income tax purposes.

The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local tax SALT deduction cap. Bracket Changes As a result of the amendments the BAIT increases to the top rate of 109 on firm income over 1M.

.png?Status=Master&sfvrsn=88ed713a_0)

New Jersey Business Alternative Income Tax Nj Bait Tax Knowledge Hub

New Jersey Pass Through Business Alternative Income Tax Bait Updates Marcum Llp Accountants And Advisors

Bamboozled Turbotax Error May Be A Problem If You Filed This Type Of Return Nj Com

New Jersey Business Alternative Income Tax Nj Bait Tax Knowledge Hub

New Jersey Tax Forms 2021 Printable State Nj 1040 Form And Nj 1040 Instructions

Bamboozled Turbotax Error May Be A Problem If You Filed This Type Of Return Nj Com

New Jersey Pass Through Business Alternative Income Tax Act Bait L H Frishkoff Company

The New Jersey Business Alternative Income Tax Nj Bait What You Need To Know Rosenberg Chesnov

New Jersey Pass Through Business Alternative Income Tax New Jersey Mercadien

Where S My Refund New Jersey H R Block

New Jersey Business Alternative Income Tax Nj Bait Tax Knowledge Hub

Number 12 Pages 1007 1120 Law Library The New Jersey State